Fast access to St. Louis, Indianapolis, Chicago, Kansas City and Des Moines.

24 May 2023

News

If you are a business owner in Jacksonville, Illinois, you need to know about Enterprise Zones (EZs) or you may be leaving money on the table. Many people are unaware they qualify for tax abatements.

In the broadest terms, EZs are geographic areas in which companies can qualify for a variety of benefits. The intent is to encourage businesses to stay, locate or expand in an EZ to catalyze community revitalization.

A misconception hindering the utilization of EZs is that the benefits are only for new projects and expansions. However, remodeling and repurposing endeavors can also be eligible. Additionally, there are incentives for both commercial and residential properties. Commercial projects are eligible for both sales and property tax abatements, while residential projects only qualify for the sales tax abatement.

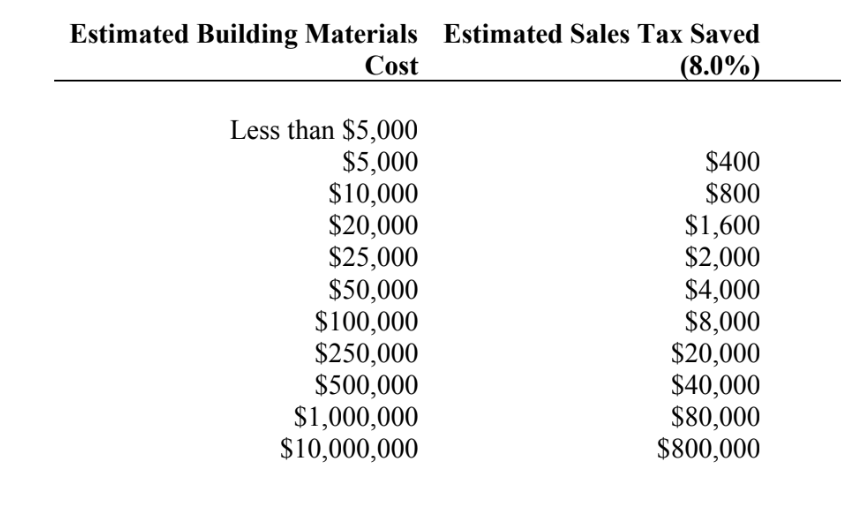

For example, a sales tax exemption on building materials can create significant savings. If $50,000 is spent on supplies, that can equal a savings of $4,000. Gaining the real estate tax abatement can provide stability because of knowing when and how much taxes will be impacted by investment and expansion.

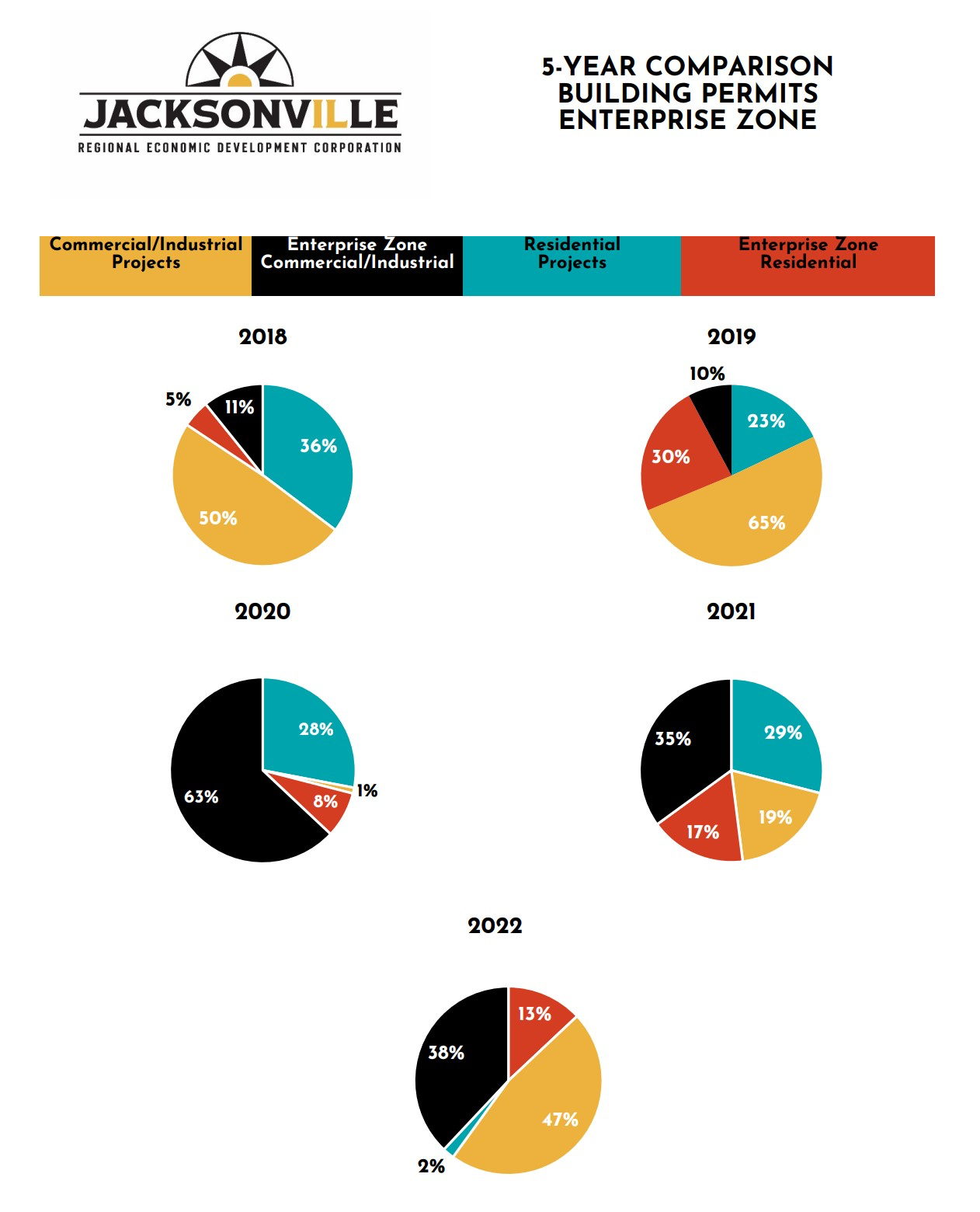

Accessing the benefits of Jacksonville’s EZs is steadily increasing. Industrial/Commercial Enterprise Zone Building permits comprised just 11 percent of those issued in 2018. There was an all-time high of 63 percent in 2020, with steady issuance of 35 and 38 percent in 2021 and 2022, respectively.

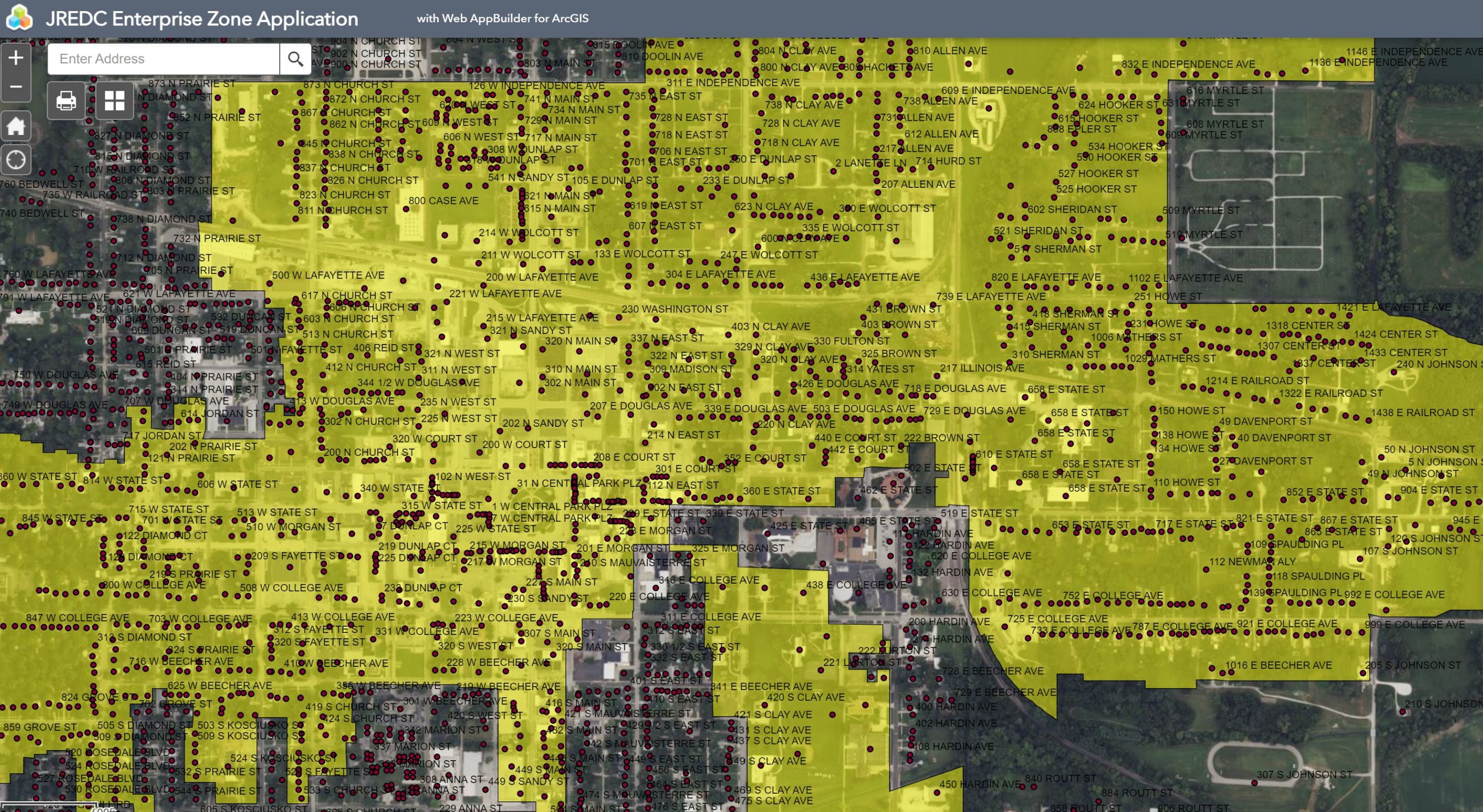

“The boundaries of our new Enterprise Zone were updated to include several older neighborhoods and Morton Avenue properties in Jacksonville, as well as the addition of properties in Meredosia, Bluffs and Winchester,” said Bonni Waters, JREDC Vice President. “The new zone also changed the benefits for residential projects. While property tax abatement is no longer offered, residential property owners can abate sales tax on permanent building materials. There were many expansions, renovations and new developments in 2020. Projects included McCallister's Deli and Taco Bell, which totaled $470,000. Springfield Clinic did an exterior renovation totaling $712,000 and we had two new facilities constructed — the Grove at Country Club Hills, a $2,250,000 development, and the Club Car Wash, which totaled $1,314,000.”

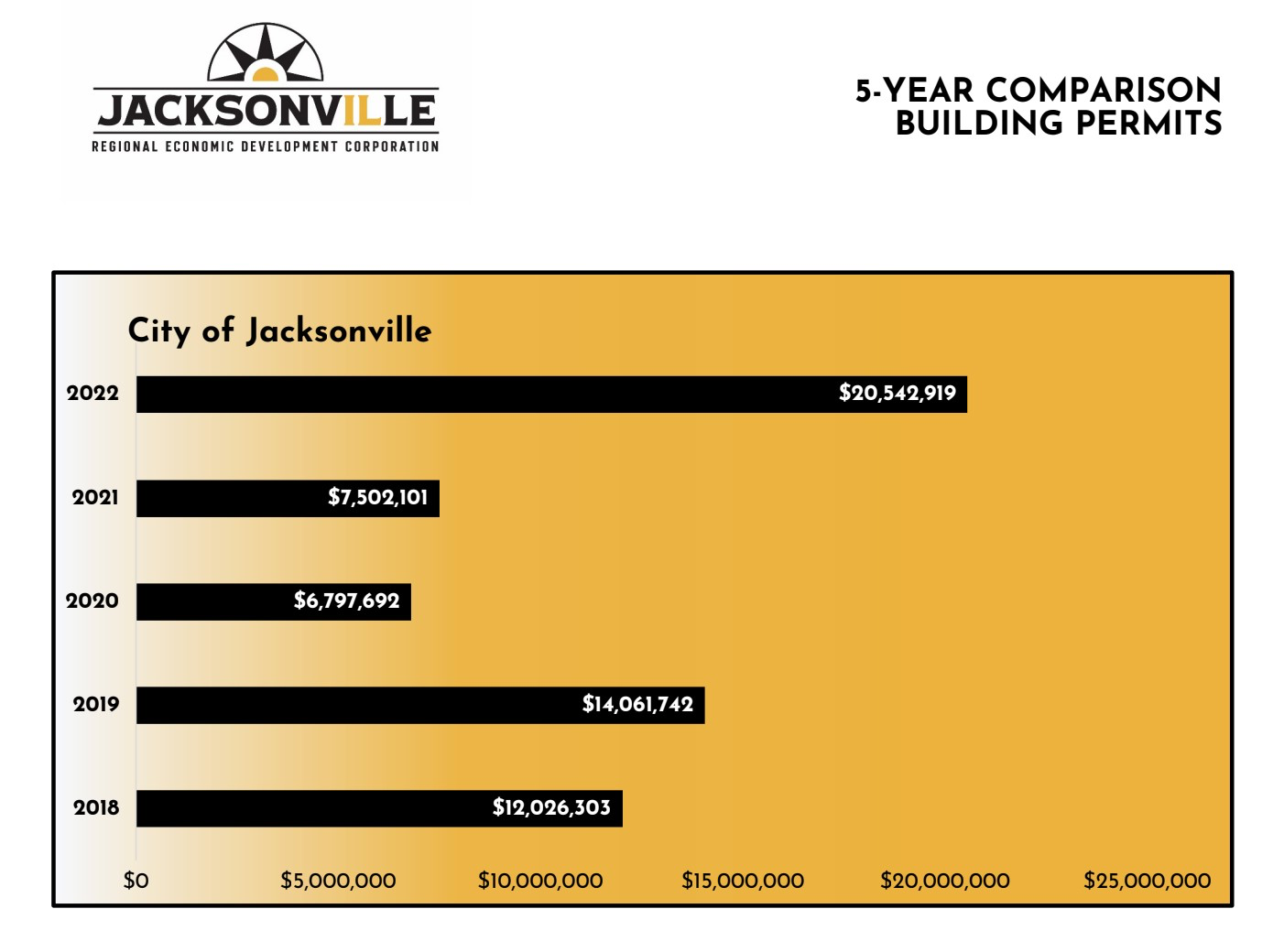

Building permits issued in 2022 represented $20,542,919 in projects ($10 million attributable to Illinois College), of which 38 percent were commercial EZ ($7,806,309). Projects included Crispin Hall renovation at Illinois College, additions to Springfield Clinic, an extensive remodel for Jacksonville Memorial Express Care and the renovation of the former U.S. Bank Building now known as The Plaza.

When MacMurray College closed, JREDC saw an opportunity to expand the EZ.

“With the MacMurray College property, the state allowed its addition to the EZ without specific project proposals, which is not typical,” said Waters. “However, we already know that the majority of the existing buildings need upgrades to meet current City codes. Taking into account the current cost of building materials, most of these projects could be put on hold indefinitely without Enterprise Zone benefits put into play. This would lead to deterioration and blight in the neighborhood. Our goal is for the former MacMurray Campus to become an asset to the community once again, alive with new uses. Luckily, the state agreed with us!”

Now that you know you should look into EZs, where do you start? Bonni Waters is JREDC’s knowledgeable resource. She can usher you through the application process with expertise. Current Jacksonville EZ maps can be accessed on the JREDC website.

Additionally, the JREDC website has applications and information:

To receive a Certificate of Eligibility for sales tax exemption and property tax abatement, you must contact Jacksonville’s Zone Administrator, Bonni Waters, at Bonni@JREDC.org or (217) 479-4627.

All recipients of Enterprise Zone benefits are required to submit an Annual Report on the benefits received, including real estate tax abatement and sales tax abatements. In addition, recipients must notify the Zone Administrator when the project is complete and provide a copy of their Annual Report to the Illinois Department of Revenue.

JREDC is your time-saving connection to resources to accelerate your project by providing the facts and figures businesses need: statistical data, general community data, topic-specific information and comparative data. Email JREDC or phone 217.479.4627 for specific information on available buildings and sites, financing and incentives, labor market information, tax information, demographics, traffic counts, retail sales data, economic indicators and trends and zoning information.

JREDC’s Employment Opportunity page is a no-cost resource analytically proven to be a valuable “one-stop-shop” benefiting local employers and job seekers alike. Follow JREDC on Facebook, LinkedIn, and Twitter.

Community Guide is Available

The City of Jacksonville is located in west central Illinois, 35 miles west of Springfield, the state capital. It is the county seat of Morgan County and one of the oldest towns in the Land of Lincoln, founded in 1825. Jacksonville was established by Yankee settlers from New England, who laid out farms, constructed roads, erected government buildings, and established post routes. They were part of a wave of European/American farmers who headed west into what was then the wilds of the Northwest Territory, during the early 1800s. Download Here!