Fast access to St. Louis, Indianapolis, Chicago, Kansas City and Des Moines.

| Minimum Rate | .200% |

| Maximum Rate | 6.4% |

| Maximum with Fund Building | 6.825% |

| Taxable Wage Base | $12,740 |

| Average rate per $100 of payroll | $2.23 |

| Business Income Tax | 7% |

| Personal Property Replacement Tax | 2.5% |

| Total | 9.5% |

Jacksonville

| State Rate | 6.25% |

| Home Rule | .75% |

| School Facility and Resource Tax | 1.0% |

| Total | 8.0% |

Morgan and Scott Counties

| State Rate | 6.25% |

| School Facility and Resources Tax | 1.0% |

| Total | 7.25% |

Real Property Tax Assessment 33.33%

Incentives

State of Illinois: Block Grant, Tax Credits, Low-Interest Loans

Morgan and Scott Counties: Enterprise Zone

Jacksonville: Revolving Loan Fund, Enterprise Zone, TIF, Opportunity Zone

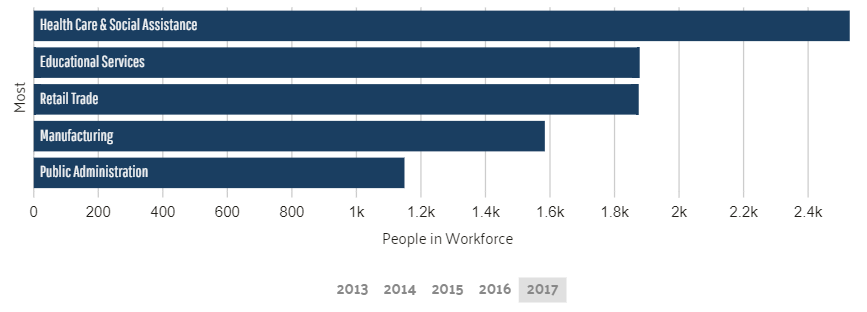

Sources: Data USA, Illinois Department of Revenue, Illinois Department of Employment Security, City of Jacksonville, Morgan County, Scott County

Community Guide is Available

The City of Jacksonville is located in west central Illinois, 35 miles west of Springfield, the state capital. It is the county seat of Morgan County and one of the oldest towns in the Land of Lincoln, founded in 1825. Jacksonville was established by Yankee settlers from New England, who laid out farms, constructed roads, erected government buildings, and established post routes. They were part of a wave of European/American farmers who headed west into what was then the wilds of the Northwest Territory, during the early 1800s. Download Here!