Fast access to St. Louis, Indianapolis, Chicago, Kansas City and Des Moines.

12 Mar 2021

News

An Enterprise Zone is a designated geographic area in which policies to encourage economic growth and development are implemented by government organizations. Incentives can include special tax breaks, regulatory exemptions, improved governmental services, or other public assistance. Enterprise Zones were introduced in the U.S. in the 1970s to stimulate economic growth and neighborhood revitalization in economically depressed areas. There are currently 97 Enterprise Zones in Illinois.

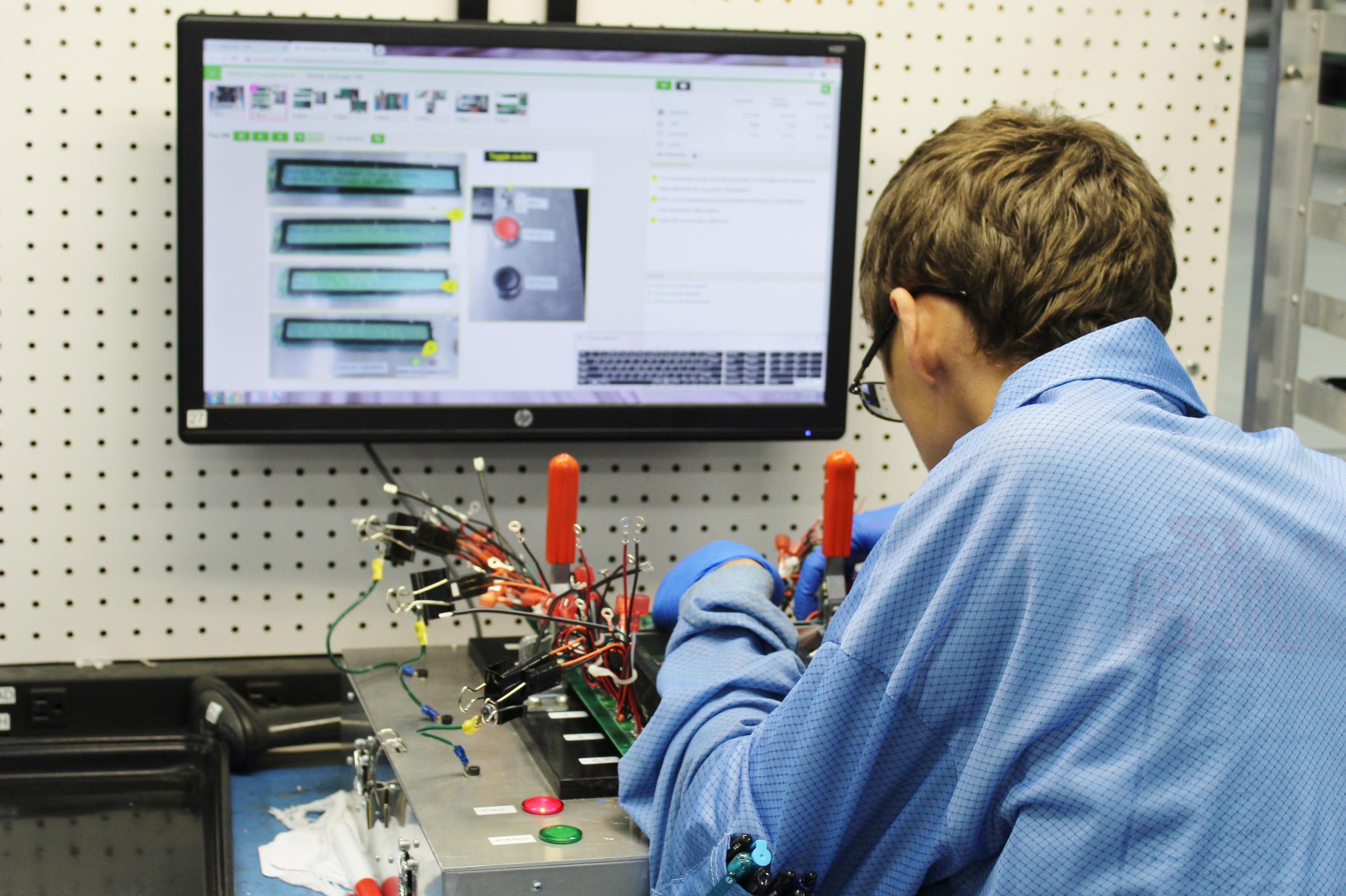

In Jacksonville, PRS Group — the company that offers the latest in pallet machinery and technology — has enjoyed the benefits of the Enterprise Zone twice: during its initial construction in the Eastgate Industrial Park and again when they expanded their manufacturing facility on the east side of Jacksonville.

“Utilizing the Enterprise Zone lowered overall costs which allowed for faster production ramp up, and future expansion,” said Jeff Williams, President, PRS Group. “PRS has realized double-digit growth year over year since our move to our Jacksonville facility and plans are in the works for future expansion.”

Jeff’s father moved PRS Group to Jacksonville from nearby Springfield almost 20 years ago when Eastgate was in its infancy to take advantage of the “lower cost of real estate acquisition and subsequent overhead.”

As listed by the Illinois Department of Commerce and Economic Opportunity (DCEO), businesses located or expanding in an Illinois Enterprise Zone may be eligible for the following state tax incentives:

Exemptions are available for companies that make minimum statutory investments that either create or retain a certain number of jobs. These exemptions require a business to make application to, and be certified by, the Illinois DCEO.

In addition to state incentives, each Zone offers local incentives to enhance business development projects. Through the Jacksonville Regional Enterprise Zone — now in its second year — valuable incentives through sales tax and property tax abatements to qualified projects are administered. There are incentives for both commercial and residential properties. Of note, the benefits are not only for new projects and expansions, but are also available for remodeling and repurposing endeavors.

“The Jacksonville Regional Enterprise Zone is one of the incentives we have to attract new business and industry to our communities,” said Bonni Waters, Zone Administrator and JREDC Vice President. “In addition to its attraction benefits, it also supports our existing business and industry by making expansion more affordable, often leading to the creation of new jobs. Our Enterprise Zone encourages investment which then stimulates business, encourages industrial growth and fosters neighborhood revitalization.”

Enterprise Zones and Bonni Waters have played significant roles in the business decisions of John and Rachel Rohn who own Fitness World Health Club and K’s Creek Golf Club. Fitness World was developed out of an existing business to now include a 24,000 square foot gym with an indoor track, golf simulators, workout space, offices, basketball courts and more. A major expansion is in the works for K’s Creek Golf Club, a beautiful 9-hole executive style public golf course.

“When we took the plunge and purchased the existing business back in 2014, the property’s location in an Enterprise Zone was a major contributing factor, even though at the time we had no visions of expansion,” said John.

“When the business started to organically expand and the need for an additional sports facility in the community became apparent, we utilized Bonni’s expertise to get us setup with our sales tax certificate which reduced the overall cost of construction,” said John. “She gave us tips on how to usher the project through the planning commission and permitting process. Ultimately, getting the real estate tax abatement was one of the final deciding factors on whether to initiate the project. Having the stability of knowing when and by how much your taxes will be impacted by this massive investment was just the peace of mind we needed to get the thing up off the ground. It has been one of the greatest decisions we made in business and it would not have happened without the help of an Enterprise Zone in Jacksonville.”

“We continue to look for ways to help expand our services to Jacksonville and the surrounding communities at both Fitness World and K’s Creek,” said John. “The two businesses work together more and more to help promote the health and wellness of our area’s youth and adults. K’s will be undertaking a major addition of their own in the coming months, again helped by being in the Enterprise Zone. We look forward to serving the community for many years to come!”

To receive a Certificate of Eligibility for sales tax exemption and property tax abatement, you must contact Jacksonville’s Zone Administrator, Bonni Waters at Bonni@JREDC.org or (217) 479-4627.

All recipients of Enterprise Zone Benefits are required to submit an Annual Report on the benefits received, including Real Estate Tax Abatement and Sales Tax Abatements. In addition, recipients must notify the Zone Administrator when the project is complete and provide a copy of their Annual Report made to the Illinois Department of Revenue.

The JREDC is your time-saving connection to resources to accelerate your project by providing the facts and figures businesses need: statistical data, general community data, topic-specific information and comparative data. In addition to Enterprise Zone information, email JREDC or phone (217) 479-4627 for specific information on available buildings and sites, financing and incentives, labor market information, tax information, demographics, traffic counts, retail sales data, economic indicators and trends and zoning information.

Community Guide is Available

The City of Jacksonville is located in west central Illinois, 35 miles west of Springfield, the state capital. It is the county seat of Morgan County and one of the oldest towns in the Land of Lincoln, founded in 1825. Jacksonville was established by Yankee settlers from New England, who laid out farms, constructed roads, erected government buildings, and established post routes. They were part of a wave of European/American farmers who headed west into what was then the wilds of the Northwest Territory, during the early 1800s. Download Here!